Nifty 50 Support And Resistance

Key Support and Resistance Levels Of Nifty

Resistance Levels Of Nifty :

Resistance Level 1 :

23,780 – This is the first barrier that Nifty 50 needs to overcome. Breaking above this level could signal continued upward momentum in the short term.

Resistance Level 2 :

24,020 – This acts as the next significant resistance. A break above this level would likely attract more buyers, potentially pushing the index higher.

Support Levels Of Nifty :

Support Level 1 :

23,490 – This is the immediate support level. If the index starts to decline, holding above this level could indicate that buyers are stepping in to prevent further losses.

Support Level 2 :

23,145 – This is a crucial support level, serving as a safety net if the index faces stronger selling pressure. A break below this level could indicate bearish sentiment.

Risk Management:

If Nifty breaks below 23,145 Support Level 2, it might indicate a stronger downtrend, signaling traders to reconsider long positions or look for potential shorting opportunities.

Targeting Resistance:

When the index approaches the 23,780 or 24,020 resistance levels, it could be an opportune moment to secure profits on long positions, as the market might face selling pressure at these levels.

Market Trend :

technical Analysis shows that the Nifty50 is Uptrend.

Bank Nifty Support And Resistance

Key Support and Resistance Levels Of Bank Nifty

Resistance Levels Of Bank Nifty :

Resistance Level 1 :

51,110 – This level represents the first line of resistance. If Bank Nifty approaches this level, traders should watch for potential selling pressure. A strong breakout above this could signal further bullish momentum.

Resistance Level 2 :

51,950 – This is a higher resistance level. If Bank Nifty breaks through this level, it may indicate a strong upward trend, as buyers could gain further control.

Support Levels Of Bank Nifty :

Support Level 1 :

49,850 – This level serves as immediate support. If Bank Nifty declines, buyers may step in here, potentially preventing a deeper fall.

Support Level 2 :

49,260– This is a crucial support level. A drop below this point may indicate increasing bearish sentiment and could lead to a more substantial decline.

Risk Management:

If Bank Nifty breaks below 49,260 Support Level 2, it might indicate a stronger downtrend, signaling traders to reconsider long positions or look for potential shorting opportunities.

Targeting Resistance:

When the index approaches the 51,110 or 51,950 resistance levels, it could be an opportune moment to secure profits on long positions, as the market might face selling pressure at these levels.

Market Trend :

Technical Analysis shows that the Bank Nifty is Uptrend.

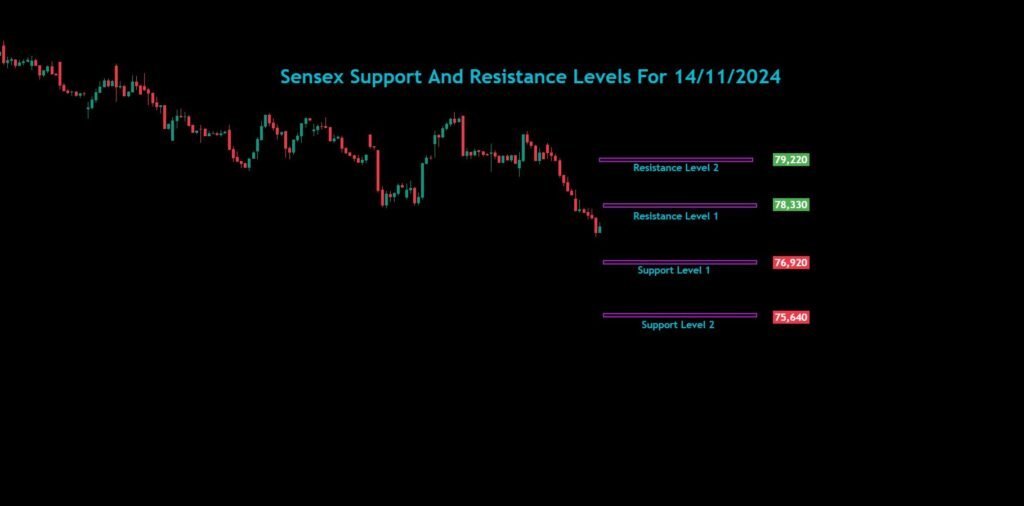

Sensex Support And Resistance

Key Support and Resistance Levels Of Sensex

Resistance Levels Of Sensex :

Resistance Level 1 :

78,330 – This level is the first point of resistance. If Sensex reaches this level, it may face selling pressure, making it a potential reversal point unless there is strong buying momentum to push it further.

Resistance Level 2 :

79,220 – This is a significant resistance level. A break above this level could indicate bullish strength, possibly leading to a continuation of the uptrend.

Support Levels Of Sensex :

Support Levels 1 :

76,920 – This is the first line of support. If Sensex pulls back, this level may attract buying interest, potentially halting further declines.

Support Levels 2 :

75,640 – This is a stronger support level. A fall below this point could signal a shift towards bearish sentiment, as it might indicate a lack of buying interest at higher levels.

Risk Management:

If Sensex breaks below 75,640 Support Level 2, it might indicate a stronger downtrend, signaling traders to reconsider long positions or look for potential shorting opportunities.

Targeting Resistance:

When the index approaches the 78,330 or 79,220 resistance levels, it could be an opportune moment to secure profits on long positions, as the market might face selling pressure at these levels.

Market Trend

Technical Analysis shows that the SENSEX is Uptrend.